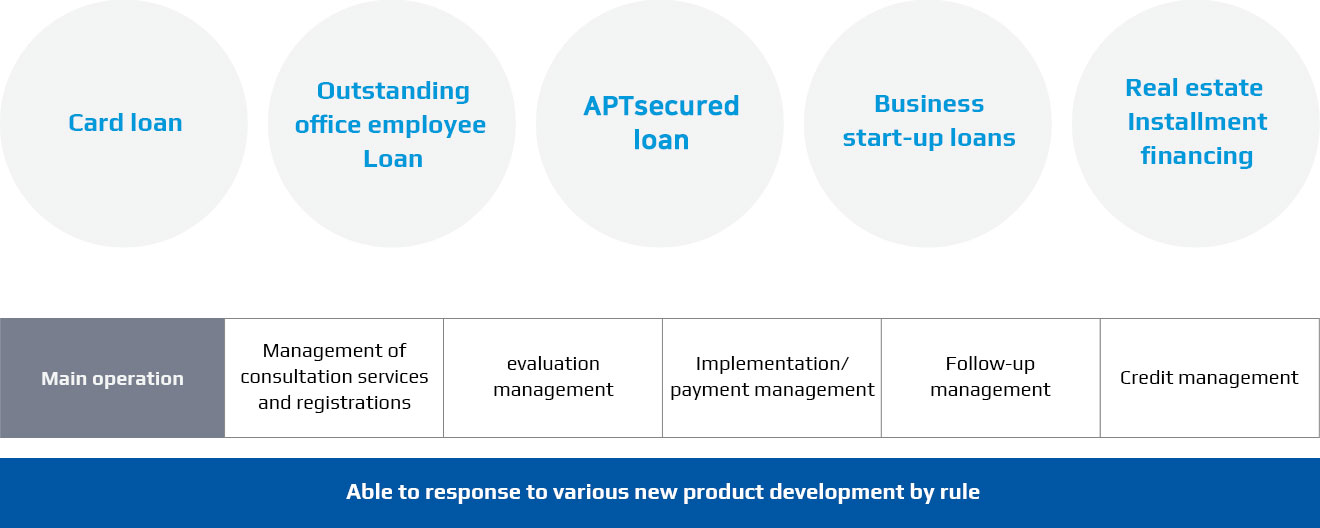

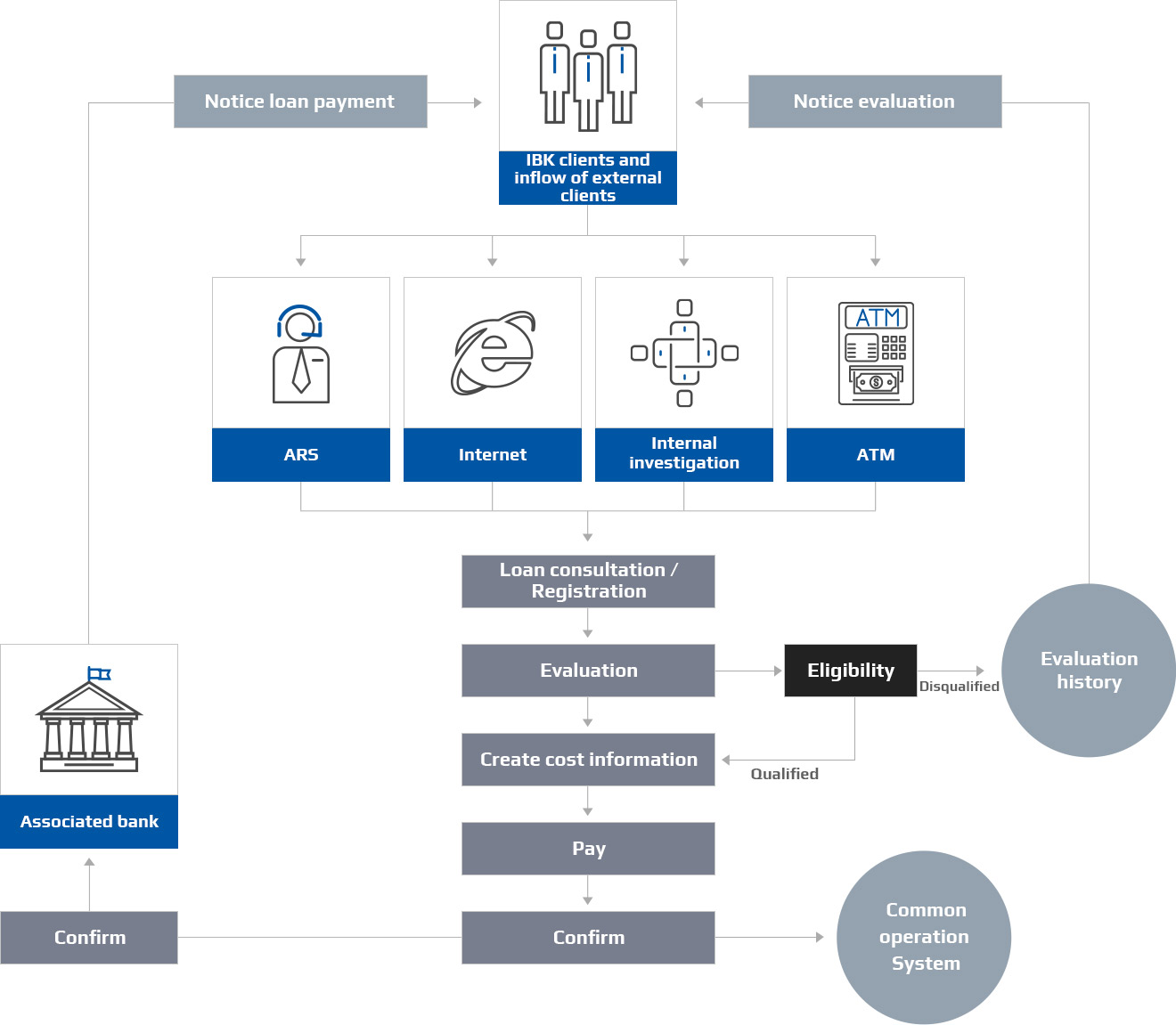

Personal finance system

User-centered, convenient personal finance system

We will help our clients to maximize their market share and also operating profit by establishing a flexible and scalable system based on client/user-centered, convenient personal financial systems through leading capitals of experience-based applications.