IB System

Definition of IB Solution

The result of aggregating IBK's IB capabilities and IBK system development capabilities as the first Inhouse IB solution in Korea

Current Status of Domestic IB Business

- IB concepts ,defined separately by market and company, are used without a clear definition according to the characteristics of atypical IB business.

- It is at the combination level of front office of foreign solutions, not core IB work, but at the level of OTC derivatives or short-term asset management of PI concepts.

- IBK is the only company that can be said to be the core of IB business, and the establishment of a back office of mid-to-long term corporate investment and process-based corporate finance.

Market Leadership in IB Business and the Advancement of IB Solutions

- Unlike foreign solutions that are not suitable for domestic environments, IBK's know-how about IB business is internalized and implemented according to the domestic environment.

- In the future, it is possible to establish its own IB solution optimized for the domestic environment.

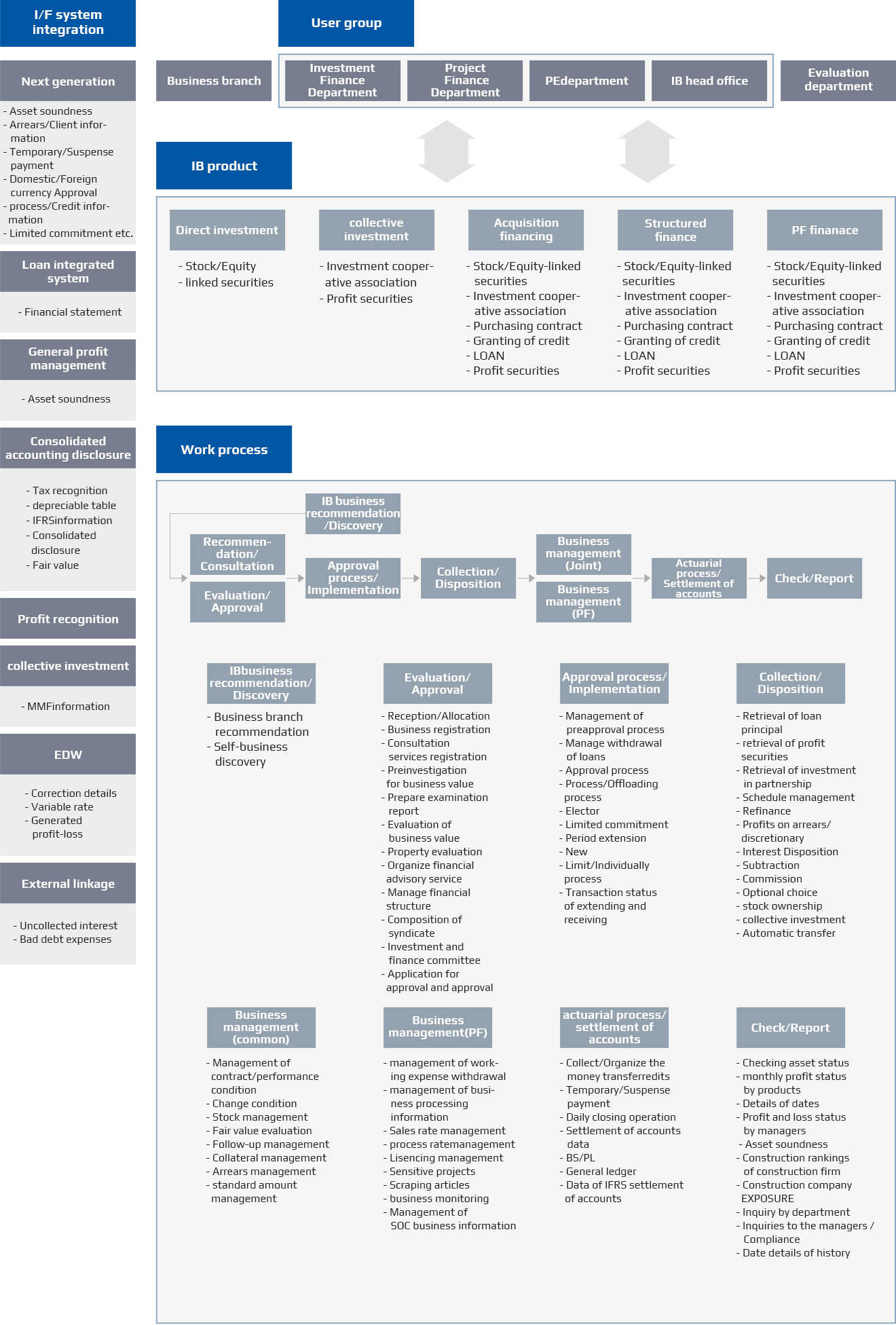

Asset management flowchart

Constitute from a product-centric system structure to a business-process-driven system configuration

- By deriving a common process for each product, we promise to derive a general process that is not dependent on a particular product.

- System that facilitates establishing strategies by industry rather than product strategy for IB market

- Establish a system to minimize the back office burden and maximize the sales capabilities

IBsystem Introduction(Features and Advantages)

It is ideal for IB operations in investment banking systems, supporting investment financing product factories, and excellent for syndicated and PEF fund operations management.

-

- Suitable system for IB operation

- System for managing transactions from customer discovery to deal closing

- Systems that support flexible system integration with the IB department's investment business and the discovery of customers at a business branch.

- System that supports convenience relating user-centered business processing and output of various reports

-

- Support investing financial factory system

- Systems that enable rapid and flexible new development through product factory

- Systems that can manage interest, fees, etc. by investing product/ business stage

- Management and provision of complex products, derivatives, etc. through the application of financial structure by product

-

- Operational management of syndicate and PEF funds

- Provides equity and asset management of major and financial investors when investing in syndicated investments

- Provides fund operating management for PEF/combination formation

- Provide accounting management functions by PEF/combinations

Introduction of investing financial system

(Expected effects after introduction)

Enhance the efficiency of work by securing adaptability to changes in the unstructured financial market environment through the establishment of an investment banking system. Moreover, it will become a leading domestic financial institution by securing investment visibility and improving external competitiveness. It can lay the foundation for generating next-generation profits for future investment finance.

Creation of Next generation Profitability of IB Operation

-

- Leading agency of IB operation

- Establishing the foundation of leading financial institutions through the computerization of IB business

- Establishing various marketing strategies using performance information

- Providing efficient investment decisions and analysis results through various statistics and analysis functions

-

- Enhance operational efficiency

- Increase the efficiency of asset allocation through early identification of revenue distribution

- Improve productivity with systematic follow-up management and extensive report

- Fast and accurate support of new product development

-

- Secure investment visibility

- A comparative analysis of complex financial information in multiple product lines on a single flatform of comparison analysis

- Real-time risk management system to secure interface of regulatory requirements

- Quick response to changes in business for investing finance

Establishment of IB System