Early Warning System

Early Warning System

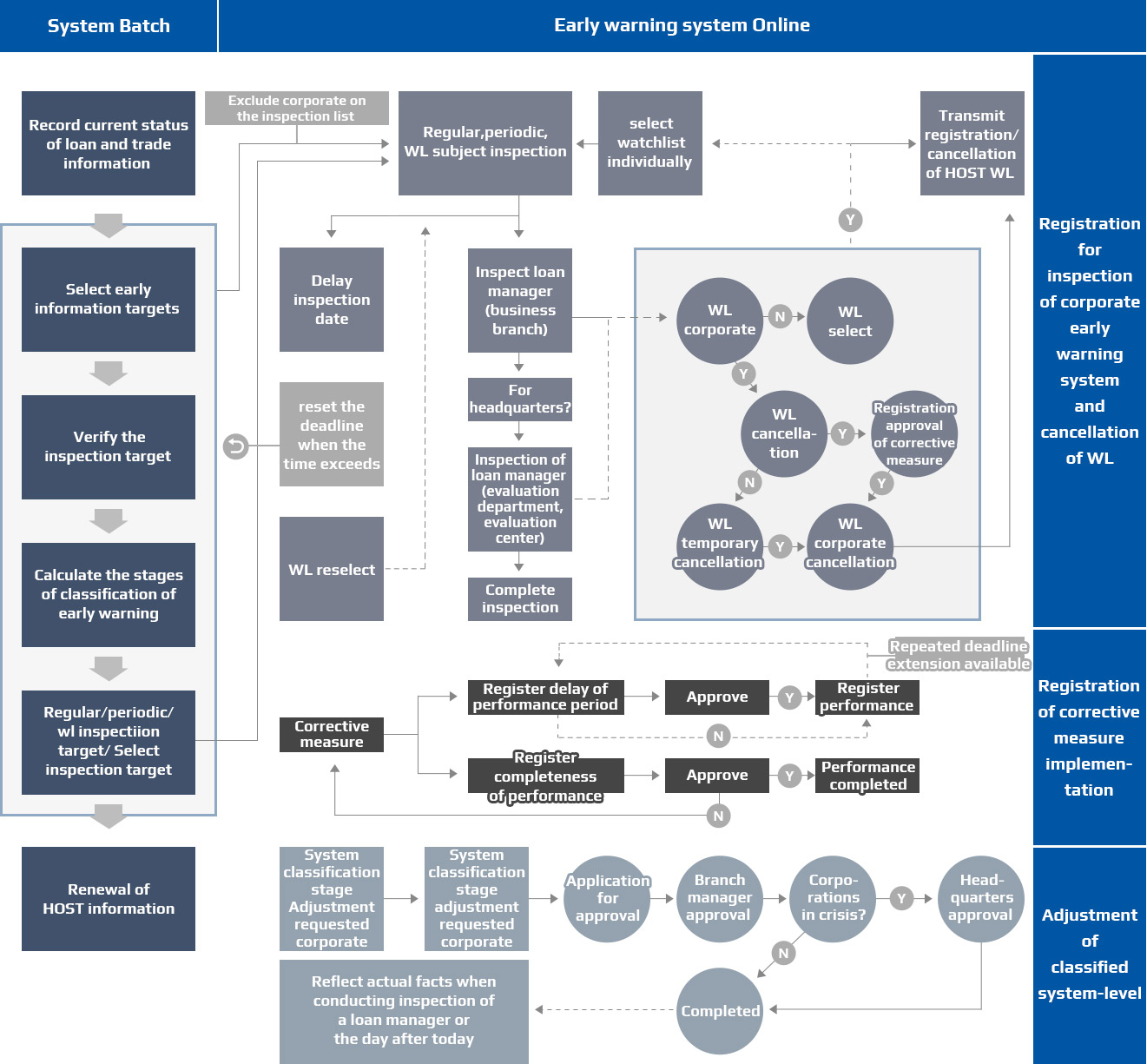

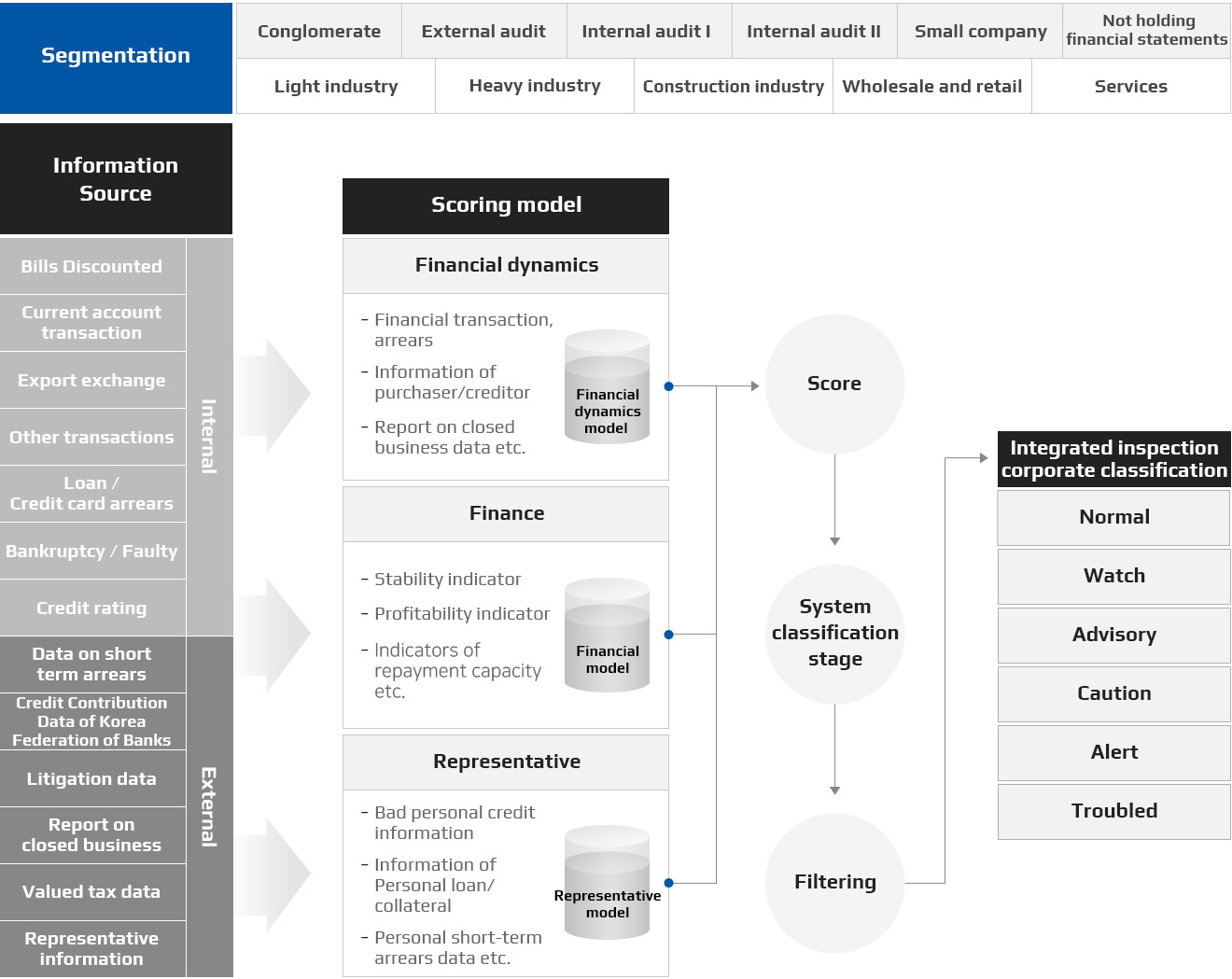

This is a monitoring system that classifies companies into several grades according to their symptoms of insolvency, as it identifies the credit risk factors in advance by reviewing qualitative factors including managerial activities as well as quantitative factors such as transaction, credit and default records. It has the function of collectively reviewing companies with loans that have a potential to go sour if any changes occur in the economy or in the management environment of the given company although it currently remains healthy. It is a preemptive system to minimize potential losses as, following the review, it selects the companies with the potential of becoming insolvent and commences intensive monitoring.