Bancassurance System

The Best Insurance Sales System, Bancassurance System

The Bancassurance system is another type of insurance sales system that is designed for convenience to users through engaging and real-time performance management, maximizing revenue generation to clients, and accurate business assistance to affiliated insurance companies.

Features and Advantages

IBK Bancassurance System

Providing the optimal solution

Creating new revenue sources and establishing IT infrastructure for integrated financial institutions

Bancassurance Relay System of Industrial Bank of Korea

IBK strategic reflection

Reflection of financial industry trends

Integrated reflection of an advanced IT technology

Componentialization of the infrastructure for integrated financial services

-

- CBA(Component Based Architecture)

- Component-based architecture

- J2EE standard web development system

- Multi-Layer architecture based on MVC

- Link to next-generation banking system architecture

-

- CBD(Component Based Development)

- Systematic iterative, development methodology of incremental component

- Development of high-quality systems in a short period of time

- Lower total cost of IT with reuse

- Achieve corporate integration and interoperability based on standards

-

- Web Services

- Easy to make an alliance by accepting business standards

- Flexible system to respond quickly and proactively to the changes in financial environment and customer needs

- Establish share-based foundation for IT resources

- Reflecting the technological capabilities of trial application to Samsung financial affiliates

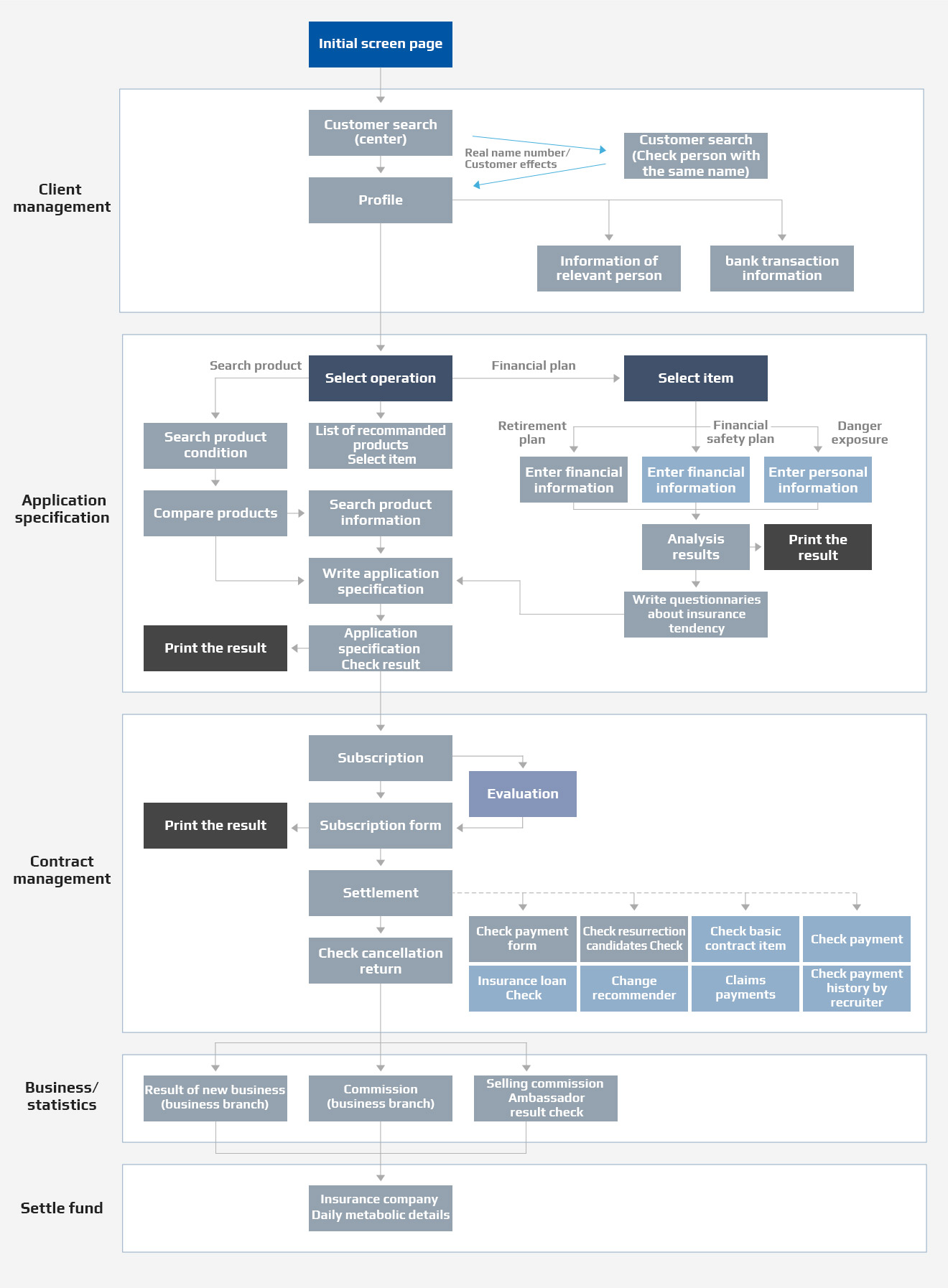

Flowchart of the whole system

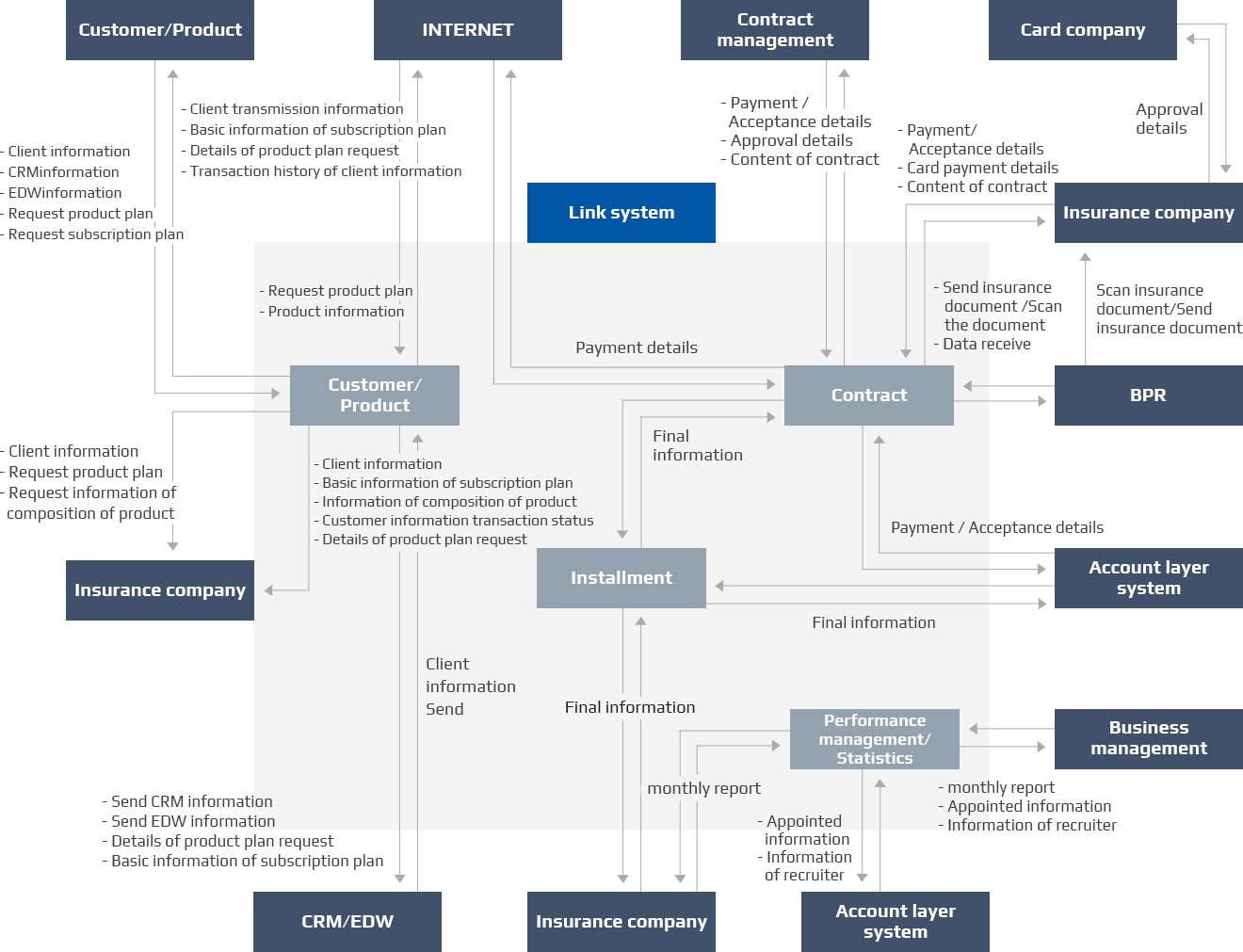

System link(DW/CRM/Image Server)

Bancassurance Operating Scope

- SoftwareSystem operation(S/W application)System software and application program

- FilesDatabase management systemMechanism of file, database, and data structure

- ServerIT-aided monitoring systemProcesses, data storage, communication interfaces and peripherals

- Communications networkNetwork management systemIT network operating system, communication equipment

- PeopleOperational organization and configurationManager, operator etc.

- OthersSecurity and safety managementSafety inspection and security management for various installation equipment