Fiscal Fund Operating Management System

Fiscal Fund Operating Management System, PROCESS Automation

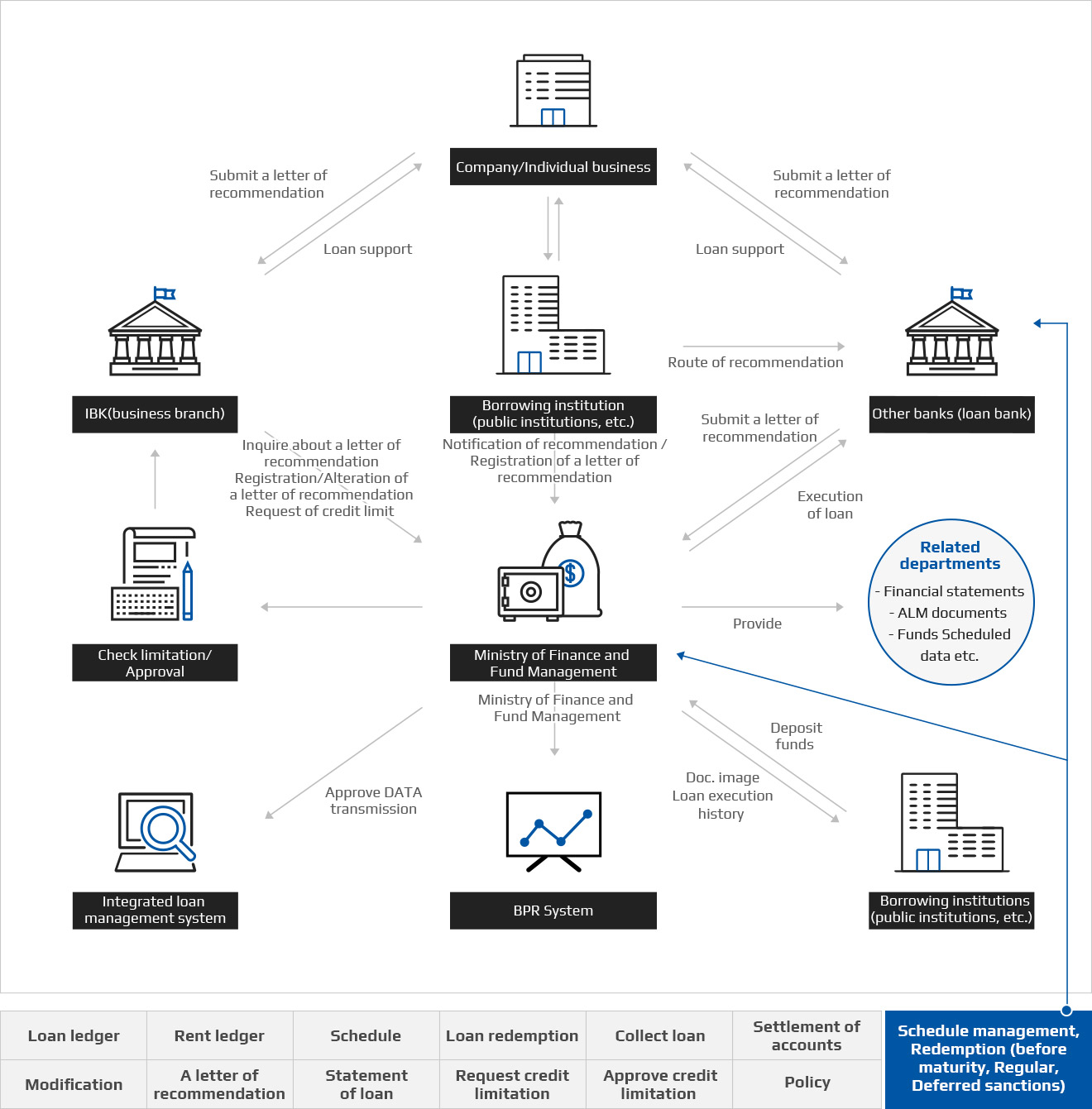

Fiscal Fund Operation is a solution formed to simplify operations and enhance productivity by automating PROCESS throughout the entire process of lending funds raised by lending institutions (KCIA, other public institutions, etc.) to companies/individuals or other banks through various procedures.

Key Functions and Features

Development by professional resourcesDeveloped by the workforce with extensive experience in finance funds

Web Environment SystemUser-centered web environment system

System Design Considering ScalabilityExcellent system design regarding expansion Linkage with Other Systems (Integrated loan system, BPR, ALM, etc.)

Verified systemPossessing a proven system of implementation at several banks, years of operational know-how.

Object-oriented application Implementationobject-oriented java application implementation

Minimize development risks-Construct systems with abundant business knowledge and experience in implementation Minimize development risks- Reduce development time based on packages

Overall business plan

Financial fund management system

- loan

- loan

- Recommendation

- Loan condition

- Borough finance

- others

-

- Borrowings

- Borrowing application Register

- Implementation and allocation of borrowings

- Borrowing repayment

-

Various analysis of report

- - Borrowing balance status

- - Borrowing redemption status

- - Specifications of date of payment

- - Current status of expiry structure

-

- Loan

- Loan implementation

- Collection of loan

-

Various analyisis of report

- - Loan balance status

- - Current status of collection of loan

- - specifications of date of payment

- - Current status of expiry structure

- - Daily, monthly date status

-

- Recommendation

-

Request for registering a letter of recommendation

- - Request for registering a letter of recommendatio

- Managing recommendation

- Managing credit line

-

Various analysis of report

- - Monthly recommendation status

- - By recommendation Current status of borrowings

-

- Borrowing conditions

- External institution management

- Management of borrowings/loan condition

- Registration management control

-

- Borough finance

- Lending application Register

- Proceed lending of funds

- lending redemption

- Various reports

-

- Others

- System common management

- BS Inspection

- Interworking with Other Systems